I think we all know what Uber is so no need for some long introduction. It is increasingly popular in cities, and it is spreading to smaller areas and towns which is nice. Also, I am going to be using it a ton next week so I will unfortunately be contributing substantially to their growth.

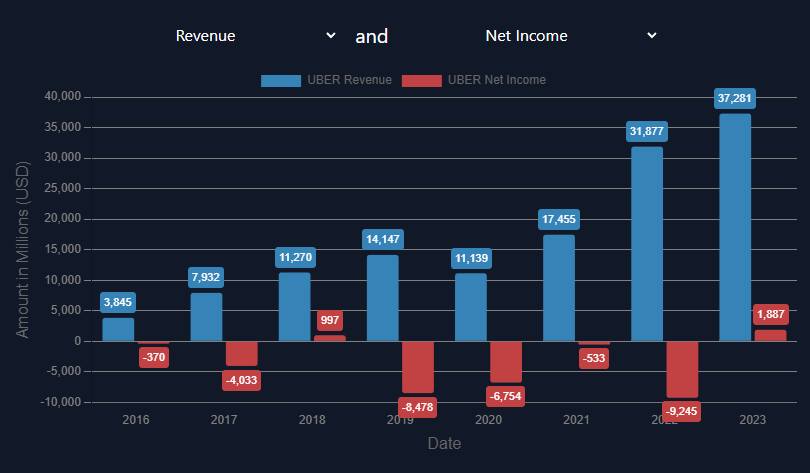

Revenue and Net Income Growth

Aside from the COVID years the revenue growth has been very strong for Uber. They have also recently become profitable and free cash flow positive which is good because they shouldn't have to raise as much capital in the future. You can raise capital by issuing debt or equity (shares) and both can be pretty bad for shareholders. They are expecting mid to high teen growth over the next few years, but this lowers to low teens when you account for the expected increase in their shares due to stock based compensation.

They are also expanding in other countries and still aren't everywhere in the United States. My hometown actually just recently got Uber. Point being, there is still a lot of room for growth, especially in other countries where car ownership may not be as popular as it is in the United States.

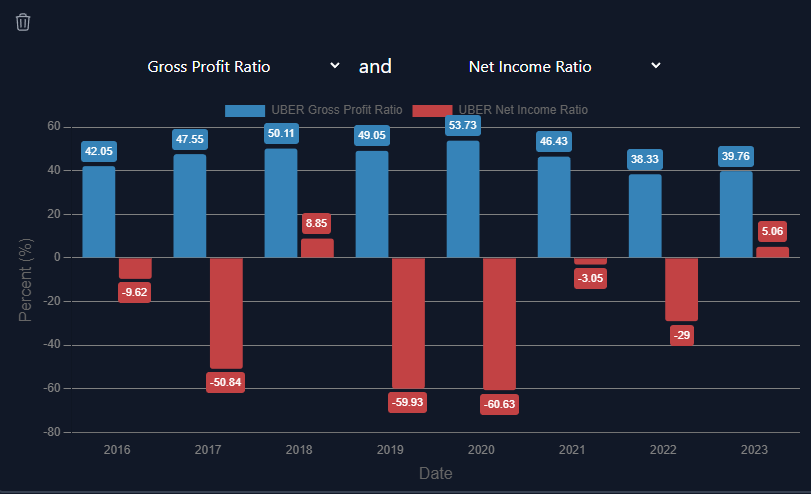

Margins

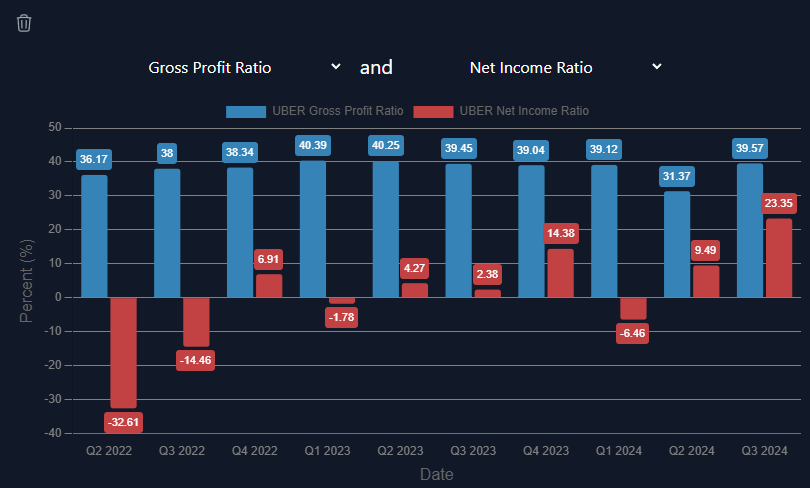

UBER's margins have fluctuated a lot since 2016. Their gross margins are slightly lower than when they started, but much lower than 2018-2021 which is honestly not that great. However, going to the quarterly view we can see that the gross margins have more or less steadied out so I would expect them to remain around 39-40% gross margins.

Since they are just recently becoming profitable their net income margins are all over the place. But I would expect their net income margins to come in around 13-16% on an annual basis once steadied. In the future there is room for these margins to expand as the company becomes more efficient and can figure out areas to lower costs. However, in the growth stage you don't typically see much of that.

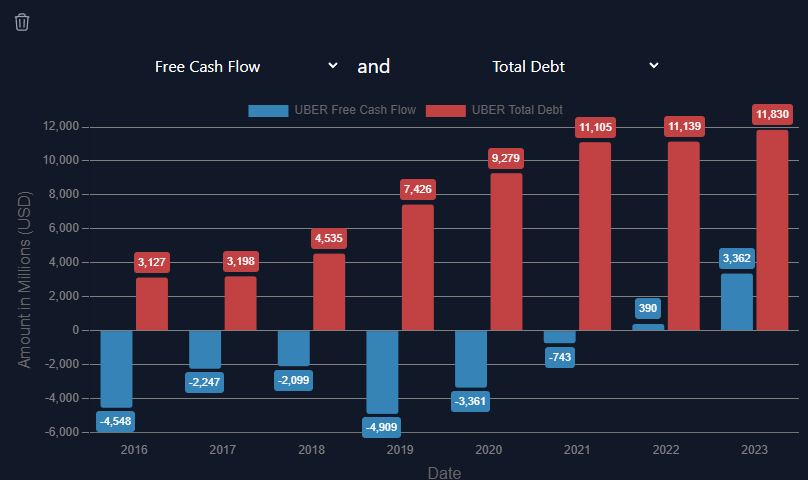

Free Cash Flow and Debt

UBER's free cash flow is expanding rapidly, from ~$3.36 Billion last year to an expected ~$7.72 Billion next year. This is massive growth and puts Uber at about 19X forward free cash flow. However, if we subtract their excessive stock based compensation which is ~$2 Billion per year then it is actually trading around 26.47X forward free cash flow. This is much higher, but still, it isn't really that terrible considering the future potential.

Furthermore, their debt levels are not an issue even after subtracting the stock based compensation from the free cash flow. And since their cash flow is growing so quickly, their debt levels shouldn't really grow that much going forward since they shouldn't need to issue debt to finance the business. Their debt is going to be ~2X free cash flow this year without subtracting stock based compensation. After accounting for stock based compensation, it will be about 3.06X.

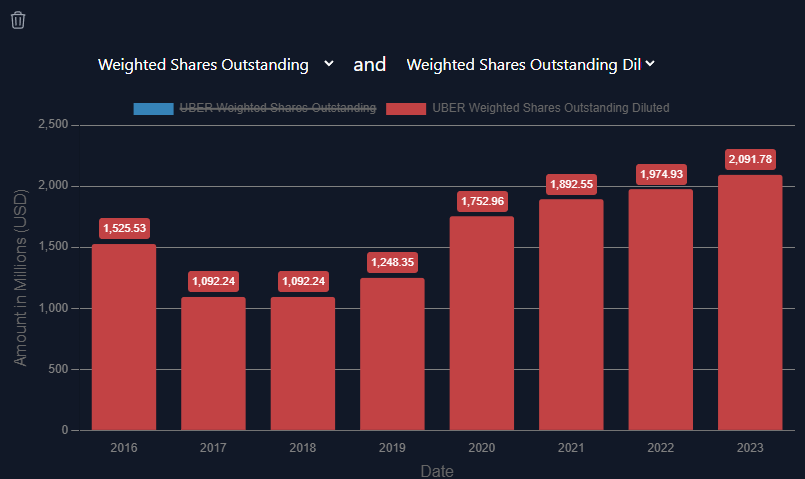

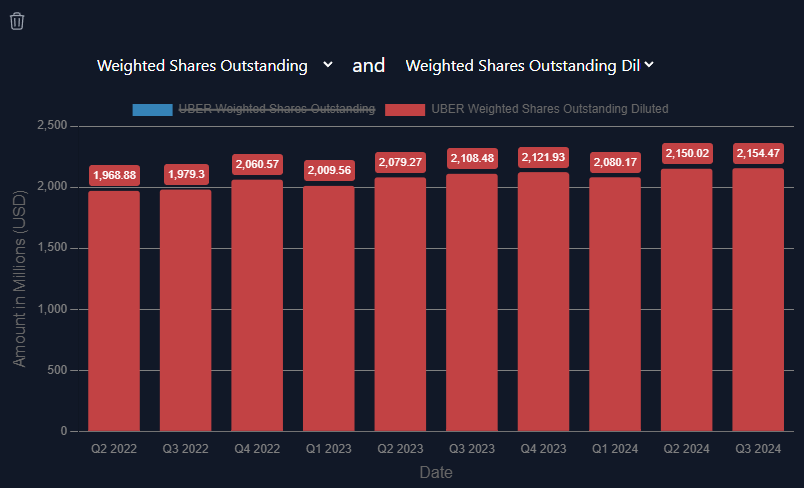

Shares Outstanding

UBER's shares outstanding have been increasing pretty rapidly. This is probably my least favorite thing about the company. This dilution of shareholders is really bad for returns. It doesn't mean you will have negative returns; it means your returns will be a lot lower than they otherwise would be due to the fact that each share represents a smaller percentage of the company than it did before.

On the other hand, as mentioned before, unprofitable companies can only raise capital through debt and equity, so they didn't really have too much of a choice for a while. However, this increase in shares is almost entirely due to their stock based compensation, not issuing shares to raise capital. This is the concerning part because they are much more likely to stop issuing shares for the purpose of raising capital when they become free cash flow positive, and much less likely to cut employees stock based compensation. Meaning this share increase will probably continue unless offset by large share buybacks.

Competition

Right now, their main competitor is Lyft. However, I quite literally have never seen someone use Lyft before. People have to be using Lyft because they are growing pretty quickly, but I do not imagine that Lyft will take over Uber. Uber kind of developed that name recognition already, sort of like Google with search engines. People say "Google it" when they want to look something up. Same sort of thing with Uber. People say, "let's take an Uber". Never heard someone say, "let's take a Lyft". It sounds stupid, but it is important when establishing and keeping market dominance.

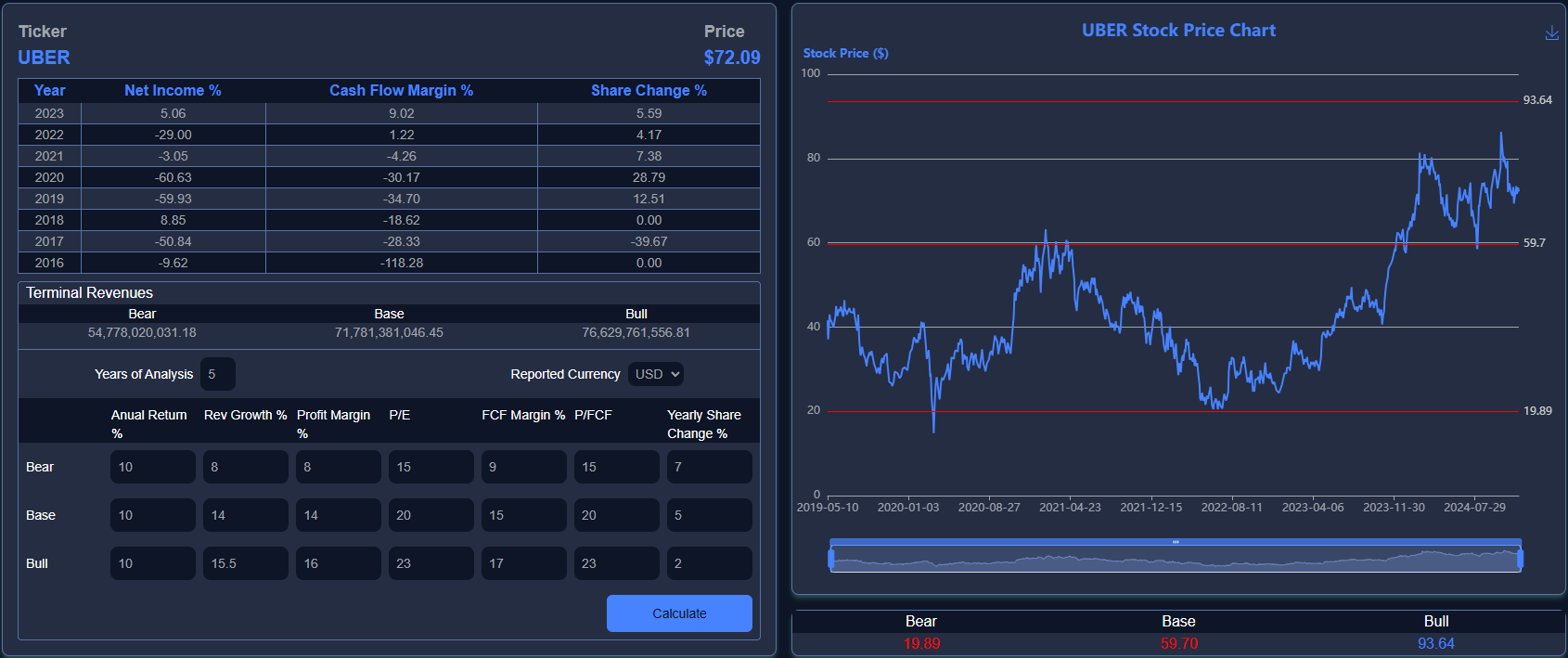

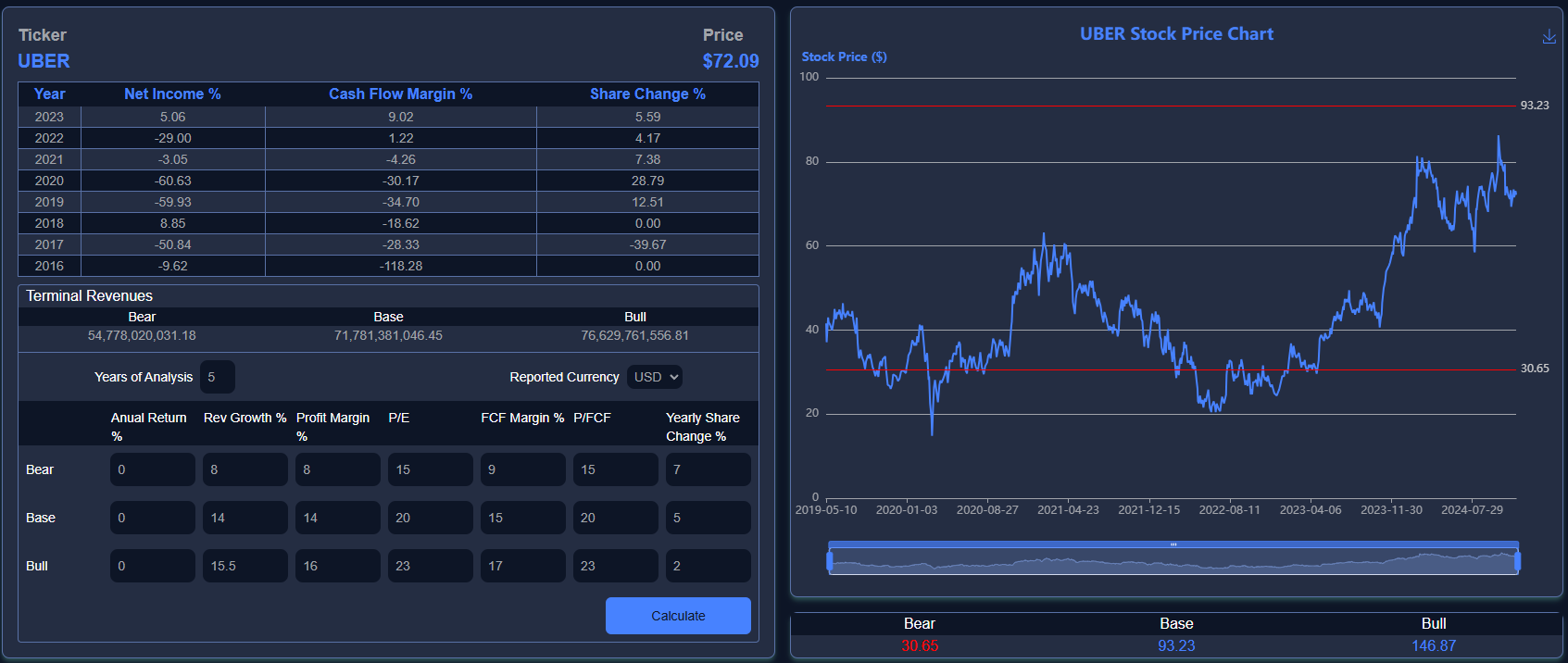

Valuation Model: Multiple of Earnings and Cash Flow

P.S. sneak peak of the new dashboard version

Here are the prices I would need to buy the stock at for the bear, base, and bull cases, to receive the Annual Return % of 10% every year for the next 5 years, assuming the inputs are correct. The major killer here is the share increases. If there were no share increases the base case would be $76.19 which is actually above today's price. However, that dilution is a real killer. An increase from the 20X multiples would increase the price drastically as well.

Here are the 5-year price targets (this is done by setting the required rate of return to zero) for the bear, base, and bull cases assuming the inputs are correct. This gives a potential 29.32% upside over 5 years on the base case and 103.73% on the bull case.

Uber is definitely piquing my interest here. I think the biggest worry is their stock based compensation that can limit the returns shareholders see. However, with them becoming increasingly free cash flow positive this could be offset through buybacks, or they can limit the amount of stock based compensation that they actually give out in compensation packages to employees and replace it with salary. I will probably sell cash secured puts and hope to get it a bit lower here.

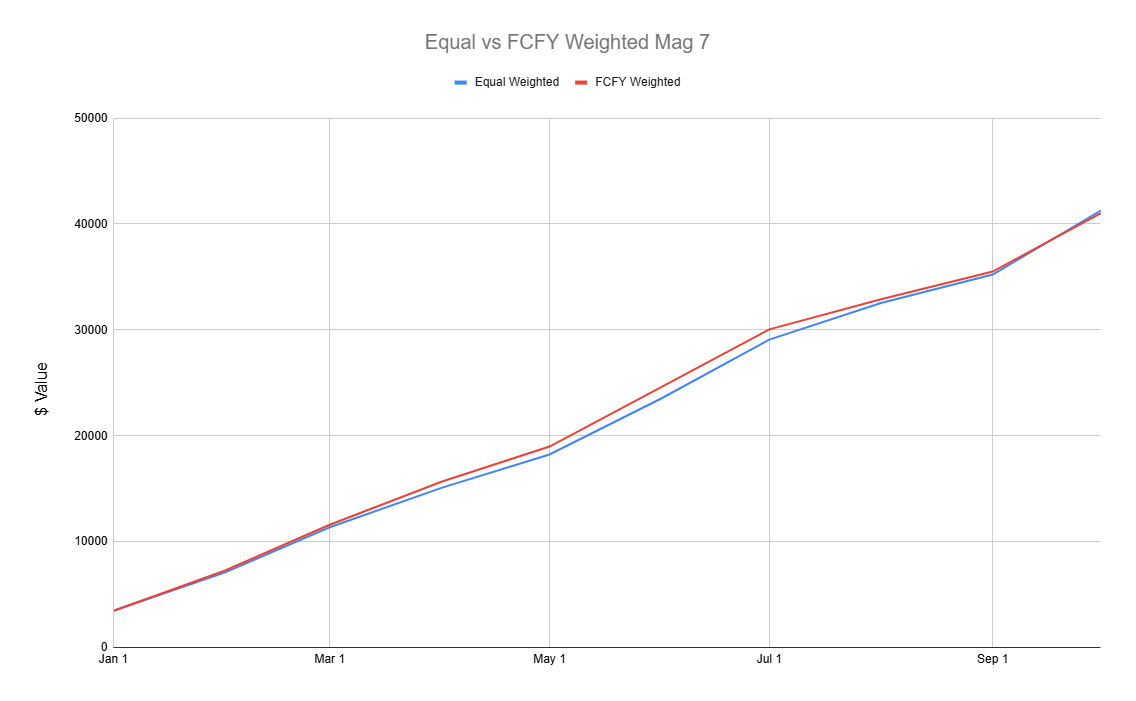

Experiment Update

Currently, the equal weighted and free cash flow yield weighted portfolio are almost the exact same value. The equal weighted one is doing a little bit better almost entirely due to the large increase in Tesla stock after Trump's Election win. Since TSLA has the lowest free cash flow yield by a mile it is underrepresented in the portfolio weighted by free cash flow yield but receives equal weight in the equal weighted portfolio. This month's dollar amount distributions went as follows.

AAPL - $440.83

MSFT - $371.19

GOOGL - $1,239.90

AMZN - $437.78

NVDA- $367.40

META - $555.58

TSLA - $78.31

Don't forget: As a member, you also get access to our exclusive community to ask questions and share ideas, our stock analysis software, and text notifications. Click here to get started.