The stock formerly known as Advanced Money Destroyer is hoping to make a name change this year as it looks to turn this franchise around. After the hype died down, AMD has collapsed over 50% from highs less than a year ago. But things are starting to look better for the company since then, not worse. This is another perfect example of the issue with buying good companies at any price. But is it still a bad price?

Revenue, Net Income, and Margins

AMD experienced extremely rapid revenue growth from 2016 to 2022, going from $4.3 Billion in revenue to $23.6 Billion. That type of growth is almost unheard of, and it draws in a ton of hype for good reason. But then in 2023, the growth stopped, and their revenue actually decreased. That is one of the worst imaginable scenarios for a company that is overhyped in the stock market due to rapid growth.

However, things rebounded in 2024, and they are actually supposed to increase that growth rate going forward. They grew about 13.7% last year and are expecting ~23.5% this year and ~21% next year. Those are the growth rates they would need to make today's price worth it in my opinion.

But the good news for them does not stop at revenue. For years they have had really bad net income margins. Typically, they would fluctuate around just a few percentage points.

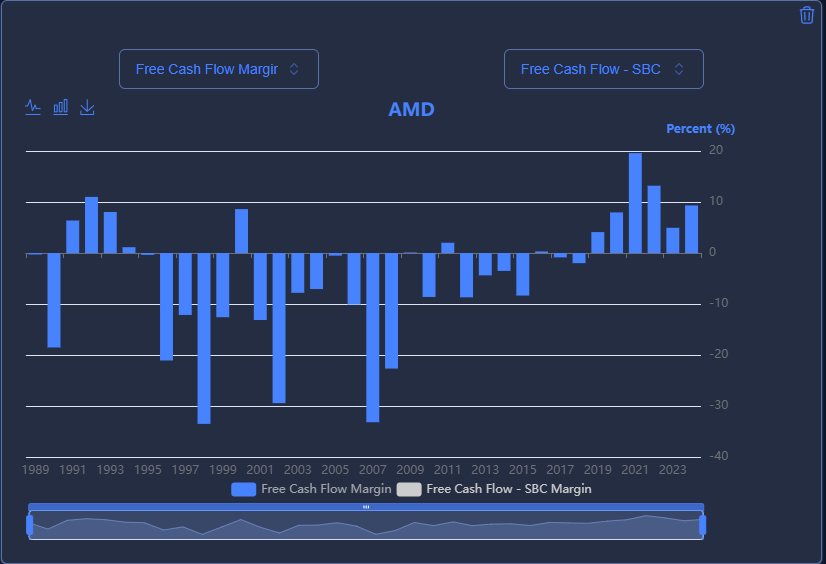

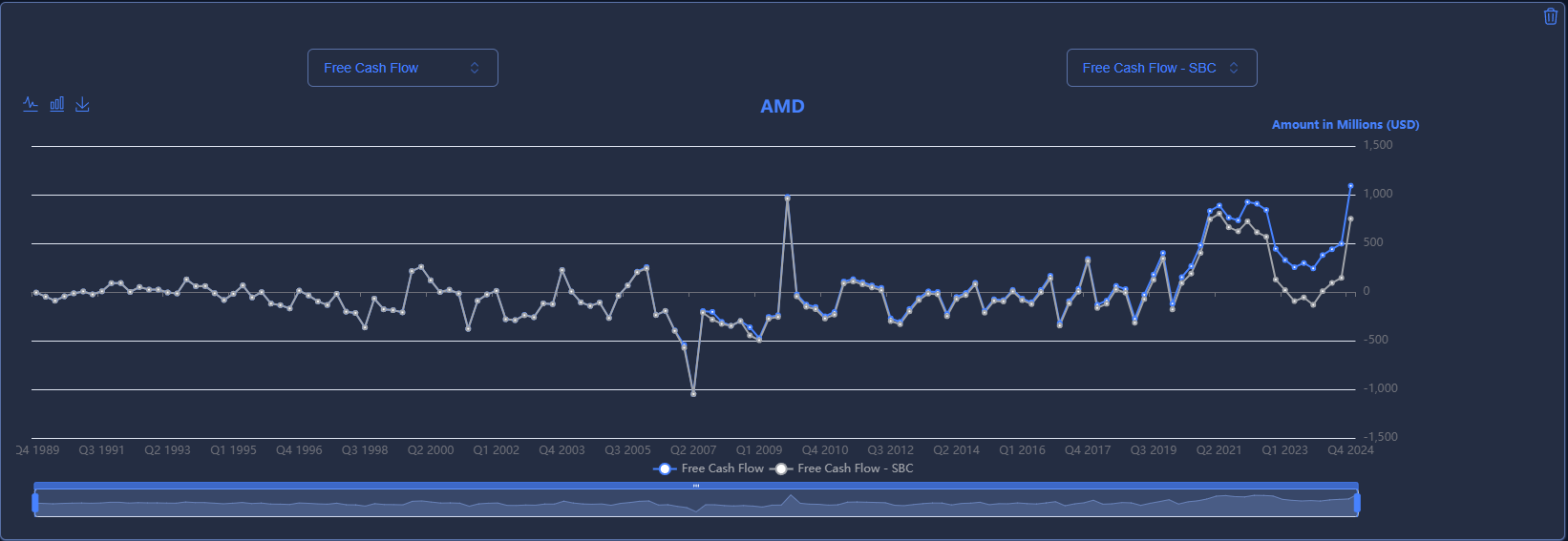

They had a few big years in the past, but for the most part they have been either really low or negative. And this is the same with the free cash flow margins as seen below.

But this is expected to change. Going forward they are expecting net margins to be in the 24-26% range, and free cash flow to be in the 20-21% range. That is a giant increase, and if sustained will add a ton of value to their company for a number of reasons.

First, they are seen as a very expensive company, and they were. But this is a company that was trading at over 1,000X earnings and is still trading at over 100X earnings. However, this is because their margins are so small that they are generating just a tiny amount of profit which makes their PE ratio extremely high. If they are able to hit the net margins that they are predicting then they are trading at 47X forward GAAP earnings, and 27X 2026 GAAP earnings (much lower multiples on non-GAAP earnings). This is a LOT lower than the 112X PE ratio they are at right now. So, the margin expansion alone will make the company look a lot cheaper in that respect.

On top of this, the drastic increases they are expecting to see in free cash flow margins will take them from $2.4 Billion in free cash flow last year to an expected $6.77 Billion this year and $7.9 Billion next year. This will allow them to invest more into their future WITHOUT taking on debt or issuing shares which is a lot better for investors. It will also open the opportunity for share buybacks to offset the massive stock based compensation. There are a ton of benefits for shareholders that would come from this massive boost in free cash flow.

Debt

AMD also has very small amounts of debt. Their total debt is only around $2.3 Billion, and they have around $3.8 Billion in Cash and Cash Equivalents, so they are actually net cash. And on top of this, their expected yearly free cash flow going forward is going to be multiple times higher than their total debt. This means they are probably not in any sort of financial risk as a company, and they could actually take on a lot more debt to fund growth before their debt would become an issue.

Shares Outstanding and Stock Based Compensation

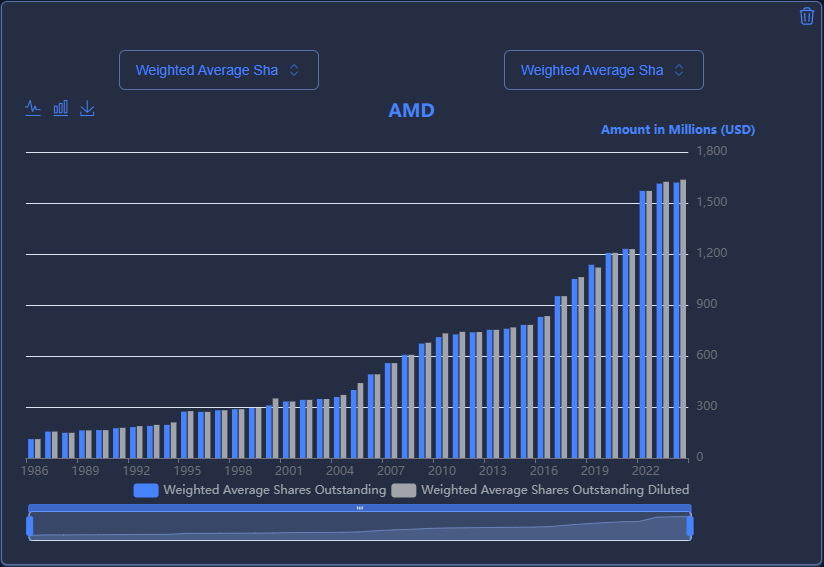

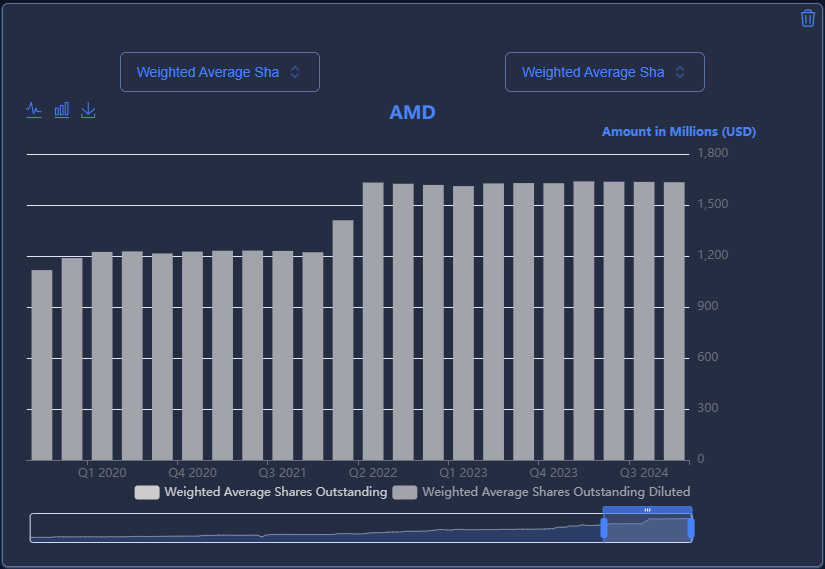

AMD has increased its share outstanding at an insanely fast rate in the past. This is really bad, however that has almost entirely stopped recently.

As you can see, their dilution pretty much stopped after the second quarter of 2022. This is really good because it means that the per share growth that investors get will be very similar to the growth that the company financials experience. Whereas before, the per share growth was significantly lower. Their expected increase in free cash flow should help put dilution to an end entirely as well as they will be able to offset their stock based compensation with buybacks.

As you can see from the graph above, their stock based compensation was very small, if it even existed for decades. But recently there has been a massive increase in stock based compensation which can be a major source of dilution. It also should be subtracted from free cash flow in order to get a more accurate free cash flow number, which is what the Free Cash Flow - SBC line does. Despite this massive increase in stock based compensation, their shares outstanding have not really increased a noticeable amount recently which is really good news as they will have even more capabilities to offset it in the future.

The Reason It Fell On Earnings

The reason AMD got crushed on earnings was because they missed on Data Center Sales estimates. They missed by less than $250 Million on a segment that grew almost 100% last year. You are going to have some error when estimating the numbers of something growing that fast, so I think it is really stupid that the reason they tanked was because of a tiny miss right there. But that can open up big opportunities for us.

Valuation

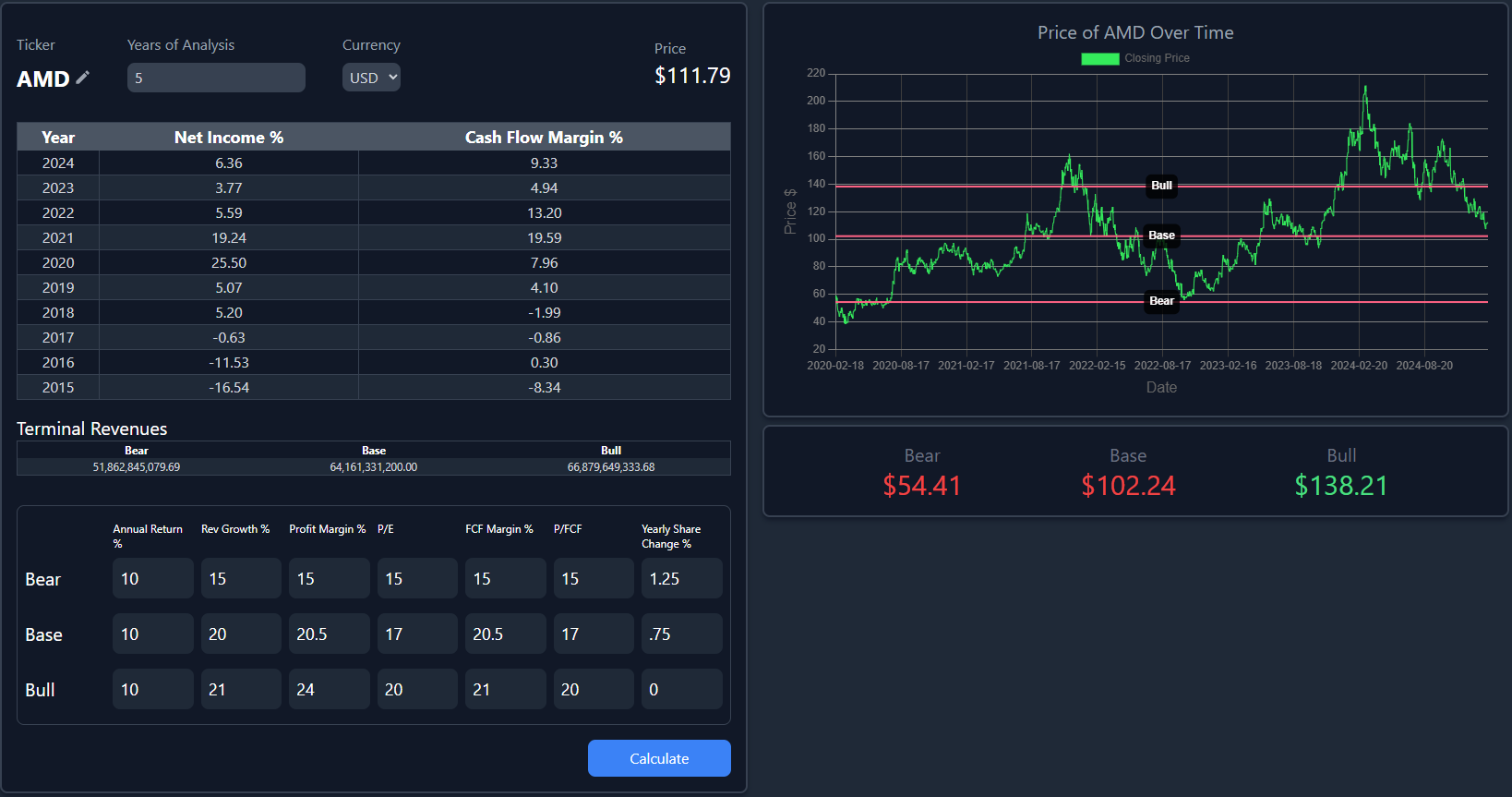

These growth and margin numbers will be based on AMD management guidance and analyst estimates.

Here are the prices I would need to buy the stock at for the bear, base, and bull cases, to receive the Annual Return % of 10% every year for the next 5 years, assuming the inputs are correct. Normally when a company has this high of growth, the multiples are higher than 17x. However, oftentimes semiconductor stocks trade at lower multiples as they have been cyclical in the past. I tried to go a little lower than the margins and growth they are expecting on the base case just to be a little more conservative. They have been beating estimates on overall growth, but I used their updated guidance so that takes some of that into account.

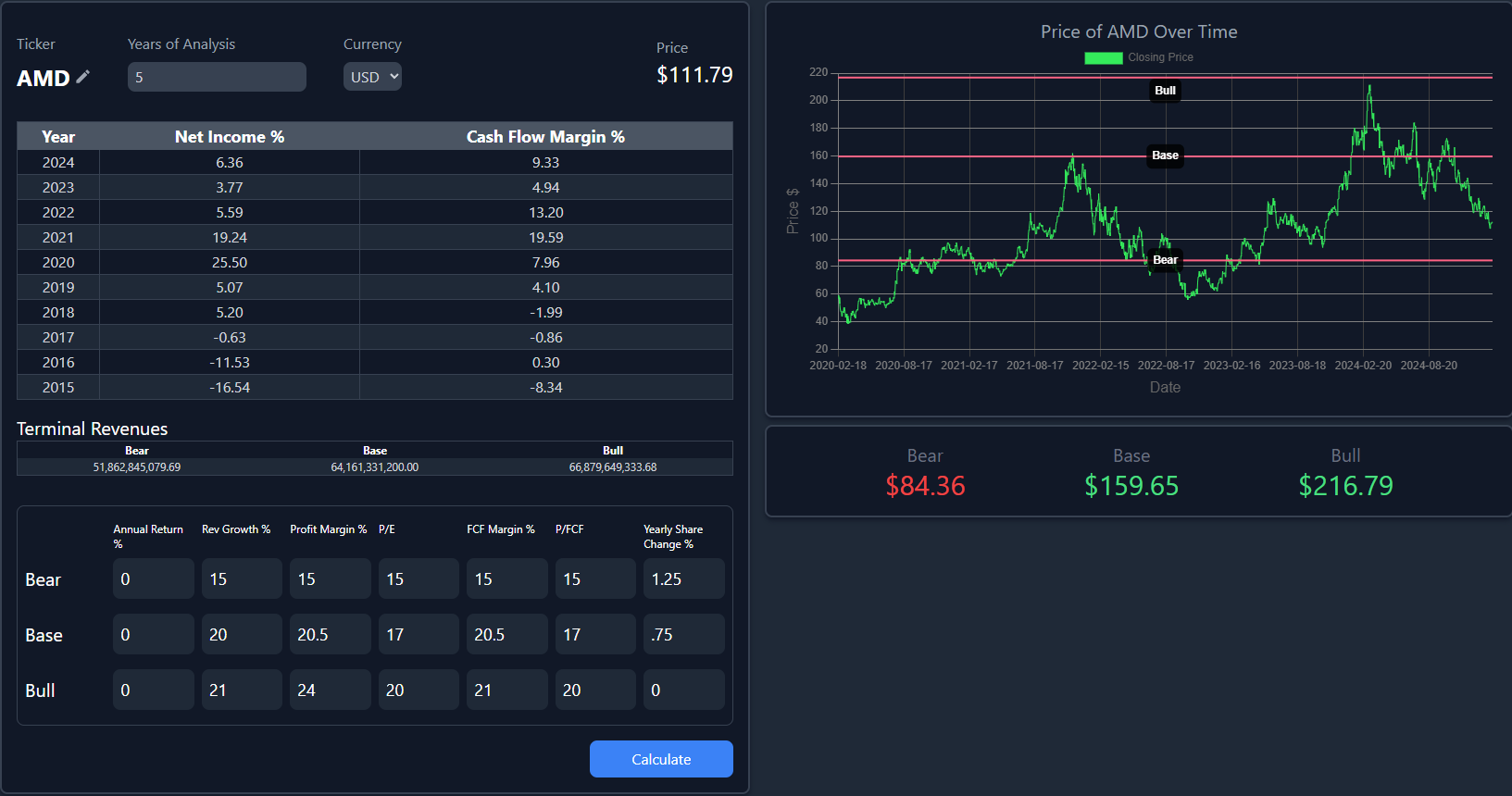

Here are the 5-year price targets (this is done by setting the required rate of return to zero) for the bear, base, and bull cases assuming the inputs are correct. If AMD trades at multiples higher than 17, then this would be a lot higher.

Conclusion

I think AMD is more or less fairly valued where it is now, but it would only take a slowdown in growth or a miss on margins to make its present value a lot lower. It is not like the company is not risky. When your company is operating in an industry that is growing as fast as chips and semiconductors, the competition gets fierce and there is a lot of room for error in the estimates and guidance given by companies and Wall Street. And there is definitely risk with tariffs that is not being taken into account with the numbers above. In fact, if tariffs make AMD stock tank really hard then that would be a much better opportunity, but it seems like they haven't had much reaction to all of the tariff news and their guidance didn't seem to suggest it would be an issue so we will see how that plays out. With all that being said I think it has a lot of potential to do very well over the next few years even if the next few quarters aren't great. But this is NOT a recommendation to buy, you should do your own research and make your own investment decisions! I would prefer to get it in the low $90's but I am not sure it will get there without some negative sentiment in the market or some bad news for the company. If bad news does come out that changes the company trajectory, that would also lower the fair value though!